We are back with our weekly RV Industry Update. It was a slow week this week but what did happen can have a profound impact on your wallet if you are considering purchasing a new RV. The policy shift is likely to shape dealership inventories and consumer pricing in the months ahead.

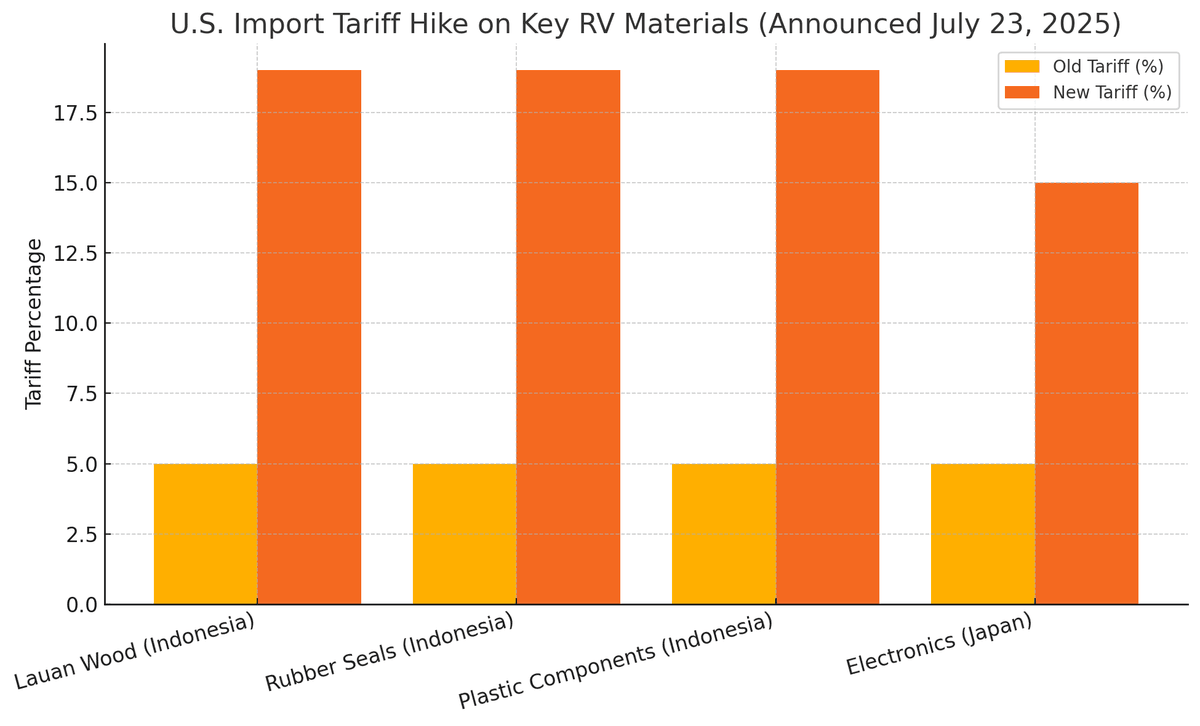

The RV Industry Association (RVIA) issued an update on July 23, 2025, detailing newly imposed U.S. import tariffs that impact core RV materials—most notably:

A 19% tariff on imports from Indonesia, including:

- Lauan plywood, a lightweight wood widely used in RV walls and cabinetry

- Rubber and plastics used in seals and floor underlayment

A 15% tariff on specific Japanese-made components, tied to a U.S.–Japan investment pact worth $550 billion

These tariffs replace older import duty rates as part of a broader strategy to adjust global supply chain dependencies and support domestic manufacturing.

Lauan wood, imported primarily from Southeast Asia, is a staple in lightweight RV builds.

A 19% increase in raw material cost could translate to:

Higher MSRP (manufacturer suggested retail prices) for entry-level towables

Reduced margins for small-to-midsize RV builders

Sourcing alternatives may increase lead times in production schedules.

Expect possible slowdowns or changes in finish materials across 2026 models if OEMs pivot to domestic substitutes.

Dealers may receive fewer inventory units at higher wholesale costs, making discounts less viable.

Consumers could see:

- Fewer “off-season” sales events

- Slower delivery of custom orders

Manufacturers are currently evaluating whether to:

- Absorb costs temporarily (to stay competitive), or

- Pass on increases to dealers and buyers starting with late 2025 or early 2026 models

Expect a mix of strategies based on company size. Larger OEMs like Thor or Forest River may manage better than smaller boutique RV builders.

What Industry Leaders Are Saying:

“These changes may challenge manufacturers in the short term but could also lead to more resilient and localized supply chains in the long run.”

— RVIA Senior Policy Director, July 23 briefing

“We’re reviewing material costs daily. It’s not just the wood—it’s also seals, plastics, and adhesives impacted by these changes.”

— OEM Procurement Manager, Indiana (via LinkedIn post)

If tariffs hold or expand, analysts predict:

Base model price increases of 2–6% by Spring 2026

Greater interest in composite materials or domestic wood substitutes

Midsize RV makers may begin reshoring certain parts of production to North America

Thank you for visiting our blog, we hope you find our site to provide you with not only fun and adventure but information and resources that will help you stay up to date on what is happening in the RV and Camping industry.

Have a great week friends,

Kirsten & Mack

P.S. Did you see our family vacationpost where we shared July 4th fun in the Smoky Mountains? Read it here.